27+ indiana mortgage exemption

Mortgage balance must be over 3000 to get a full deduction. Property owners must maintain a balance of 3000 or more at all times on their recorded mortgage or line of credit if your principle loan is paid in full to be eligible to receive the benefit of this deduction.

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

Web Deductions Property Tax.

. The mortgage must be recorded in the Henry County Recorders office. For single debtors filing it has no coverage limit. Reducing the taxable value of the home by 3000 this deduction is for Indiana residents who maintain a mortgage on their home.

One homestead only per married couple is allowed in the State of Indiana per IC 6-11-12-37. This form can be mailed or brought into the Auditors Office located at Room 208 Civic Center Complex 1 NW Martin Luther King Jr Blvd Evansville IN 47708-1880. Web Homestead Exemption and Over 65 Maximum Assessed Valuation.

Application for deductions must be completed and dated not later than December 31 annually. This exemption provides a deduction in assessed property value. Web Homestead Standard Deduction.

27-1-12-14 to cover life insurance spouse. Notice of Change of Use on Property Receiving the Homestead Standard Deduction. The deduction amount equals either 60 percent of the assessed value of the home or a maximum of 45000.

Web Mortgage must be recorded before filing for exemption. The form with the qualifications can be found here in the Auditors Department page. Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property.

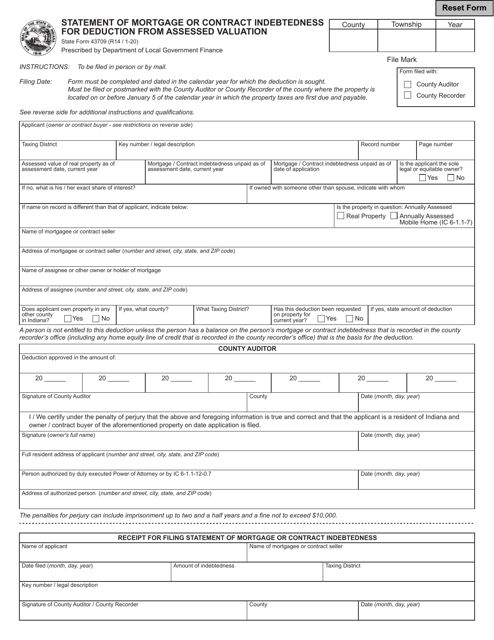

Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation. 1 2023 the mortgage deduction has been repealed however the homestead deduction has been increased from 45000 to 48000. Web Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence.

Web Todays mortgage rates in Indiana are 6603 for a 30-year fixed 5723 for a 15-year fixed and 6952 for a 5-year adjustable-rate mortgage ARM. On March 21 2022 Governor Eric J. If the balance is less than 3000 the current balance will be allowed.

To view all available deductions types or to obtain deduction forms please view the Indiana Property Tax Benefits Form PDF. Web For 2022 pay 2023 cycle 3000 is deducted from the assessed value of the property. For single debtors filing it has no coverage limit.

Authority for signing a deduction application my be delegated only by an executed power of attorney or by IC 6-11-12-07. 18163 A homeowner or an individual must meet certain qualifications found in the Indiana Code. 27-1-12-171 f Most people use Ind.

Lesser of 45000 or 60 of the gross AV of the property Applies to the dwelling and those structures attached to the dwelling deck patio etc and the surrounding 1 acre even if acre straddles multiple parcels. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever is least. Web Most people use Ind.

Filing for the Deduction. Up to 45000 if residential assessed value is 75000 or over 60 of residential assessed value if under 75000 Must reside on the property and own by December 31. Web The deduction equals 3000 on-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever is least.

Web If you own a home or mobile home and are buying on a recorded contract and use it as your primary place of residence your home and up to one acre of land could qualify for a Homestead deduction. 27-1-12-171 f to cover employers life insurance. Taxpayers do not need to reapply for deductions annually.

Authority for signing a deduction application may be delegated only by an executed power of attorney or by IC 6-11-12-07. Exemption amount dependent on assessment. Application for Senior Citizen Property Tax.

Web For questions regarding your current deductions call the Hancock County Auditor at 317-477-1105. Here is a link to the IN State website to view the Mortgage Deduction form. For property tax assessments beginning Jan.

Have you refinanced your mortgage changed your name changed ownership or moved. Homestead Change of Use. Web Mortgage Deductions You must be a resident of the State of Indiana and only one mortgage deduction is allowed.

Holcomb signed into law House Enrolled Act 1260-2022 HEA 1260. Web If you purchased a home or refinanced the mortgage exemption form is not filed for you at closing. Web One of the most filed deductions is the Mortgage Deduction.

You must file the form before December 31 to receive the deduction for the following years property taxes. Over 65Over 65 CB. Web Deduction amount.

Web Where do I apply for mortgage and homestead exemptions. Your deed must be recorded so its a good idea to wait at least 30 days after closing. Both can be filed in the Auditors office.

Application for deductions must be completed and dated not later than December 31 annually. Web Filing Exemptions Indiana Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property.

Save Money By Filing For Your Homestead And Mortgage Exemptions

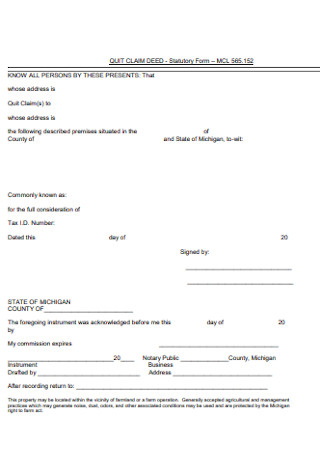

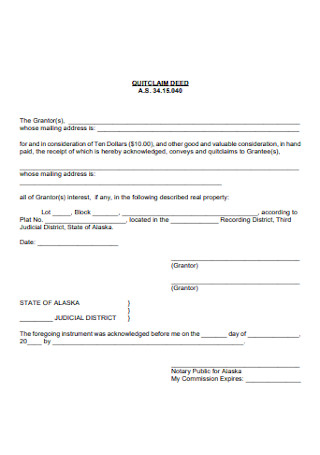

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Save Money By Filing For Your Homestead And Mortgage Exemptions

Wayne County News 05 23 12 By Chester County Independent Issuu

Dva Indiana Mortgage Company Inc

Uonex4nhzzxljm

27 Sample Quit Claim Deed Forms In Pdf Ms Word

27 Sample Quit Claim Deed Forms In Pdf Ms Word

State Form 43709 Download Fillable Pdf Or Fill Online Statement Of Mortgage Or Contract Indebtedness For Deduction From Assessed Valuation Indiana Templateroller

Mountain Times Volume 49 Number 10 March 4 10 2020

1 Utep University Of Texas At El Paso

Gaz 11212014 By Shaw Media Issuu

Indiana Mortgage Deduction To End January 1 2023 Metropolitan Title

Which Are The Top Colleges For Mba In Finance Specialization Quora

General Officers Report To The 42 Convention Of Iron Workers By John Good Issuu

Executive Portfolio Vol 10 Iss 8 By Blue Heron Publications Llc Issuu

Indiana Essentials Of Mortgage Loan Origination